CSD Enrollment Levels On Track To Post Another Healthy Gain This Year

Decatur Metro | April 14, 2015 | 1:11 pmCSD’s regular enrollment table updates are a great way to keep an eye on Decatur’s most talked about topic.

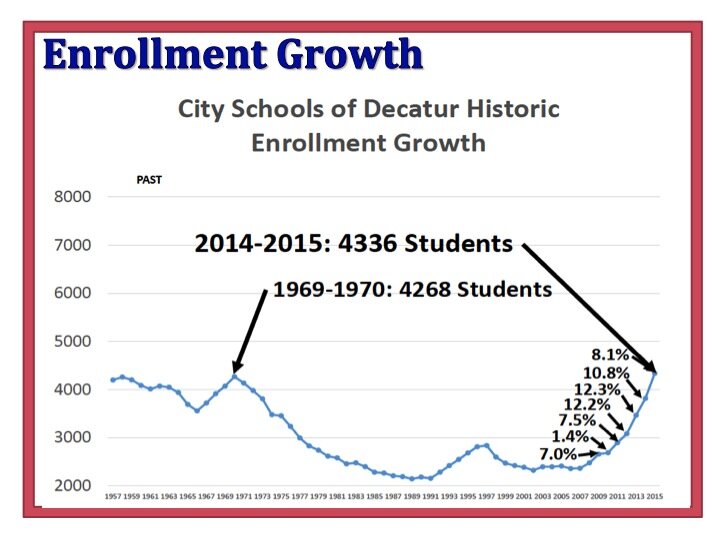

The chart above is set up to track against projected levels for the coming year, but we can also used the data to make comparisons to get a sense for what is actually happening.

First of all, as you can see above, enrollment for next year has already surpassed the final levels for the current school year (4407 vs. 4344). While Kindergarten is still has a ways to go – since many in that grade are new to the system and need to actively enroll – many other grades for next year are at or above the previous enrollment level last year.

However, perhaps an even more telling comparison at this juncture isn’t included in the chart above.

What if we were to a look at enrollment levels for the following year now and vs. the same period last year? Luckily we are proficient enough in CSD’s eBoard system and Excel to put together a little table that shows just that.

As you can see from the above, CSD’s enrollment levels thru March 27th are already up 9% vs. enrollment levels thru one week earlier last year. (That’s as close as I could get from the data available) This seems to indicate that so far this year, enrollment is still growing near CSD’s projected 10% rate.

As you can see from CSD’s line chart below, enrollment increases have fluctuated between 8%-12% over the last 5 years. This early indication seems to show that this trend could easily continue into the next school year.

)

)